Best Indicators for Forex Trading Maximize Your Profit Potential 1729813266

Best Indicators for Forex Trading: Maximize Your Profit Potential

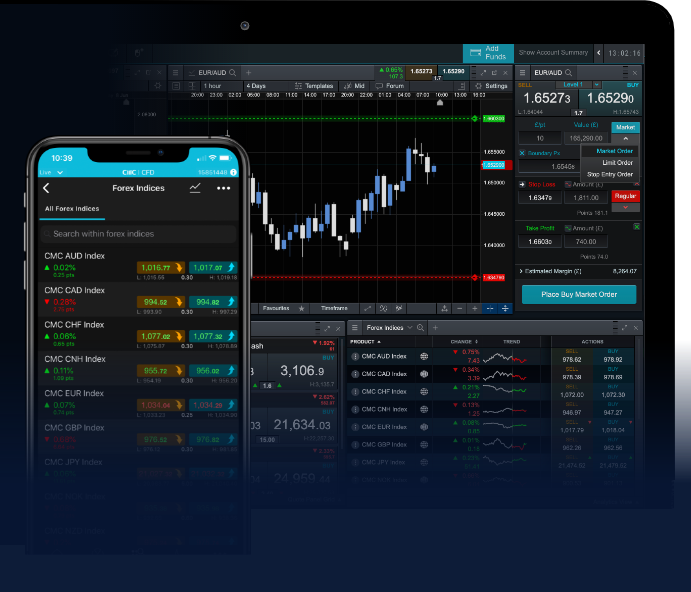

In the fast-paced world of Forex trading, having the right tools at your disposal is crucial for making informed decisions. The best best indicators for forex trading Trading Platform VN allows traders to harness these tools effectively. Among these tools, indicators serve as essential elements that can significantly influence trading strategies and outcomes. This article explores the top indicators for Forex trading and provides insights on how to utilize them effectively for successful trading.

1. Moving Averages (MA)

Moving averages are one of the most popular indicators in Forex trading. There are two main types: Simple Moving Averages (SMA) and Exponential Moving Averages (EMA). The SMA provides the average price over a specified period, while the EMA gives more weight to recent prices, making it more responsive to new information.

Traders often use moving averages to identify trends and potential reversal points. A common strategy is to look for “crossovers,” where a shorter-term moving average crosses above or below a longer-term moving average, signaling potential buy or sell opportunities.

2. Relative Strength Index (RSI)

The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change of price movements. The RSI ranges from 0 to 100 and is typically used to identify overbought or oversold conditions in a market. Generally, an RSI above 70 indicates an asset is overbought, while an RSI below 30 signals it may be oversold.

Traders use the RSI to confirm trends and potential reversals. For example, during an uptrend, if the RSI falls below 30, it might indicate a buying opportunity, while a decline below 70 in a downtrend could suggest a selling opportunity.

3. Moving Average Convergence Divergence (MACD)

The MACD is a trend-following momentum indicator that shows the relationship between two moving averages of a security’s price. It consists of three components: the MACD line, the signal line, and the histogram. When the MACD line crosses above the signal line, it is often considered a bullish signal, while a crossover below can indicate a bearish signal.

The MACD is also effective for identifying momentum strength and potential reversal points through divergence analysis, where the price action diverges from the MACD trend.

4. Bollinger Bands

Bollinger Bands are volatility indicators that consist of a middle band (SMA) and two outer bands plotted two standard deviations away from the middle band. The bands expand and contract based on market volatility, allowing traders to identify whether a market is overbought or oversold.

Traders often look for price action to reach the outer bands, suggesting a potential reversal or continuation of the trend. A price that touches or breaks the upper band could be a signal to sell, while a touch or break of the lower band might present a buying opportunity.

5. Fibonacci Retracement

Fibonacci retracement is not a traditional technical indicator but rather a tool for identifying potential support and resistance levels. Traders use the Fibonacci sequence to identify retracement levels during pullbacks and corrections. The most common retracement levels are 23.6%, 38.2%, 50%, 61.8%, and 100%.

These levels can help traders make better entries and exits by providing potential reversal points during an established trend. Combining Fibonacci levels with other indicators for confirmation can lead to more robust trading decisions.

6. Stochastic Oscillator

The Stochastic Oscillator is a momentum indicator that compares a security’s closing price to its price range over a specific period. It ranges from 0 to 100 and is used to identify overbought or oversold conditions. A reading above 80 typically indicates overbought conditions, while a reading below 20 indicates oversold conditions.

Similar to the RSI, traders often use the stochastic oscillator to confirm other indicators. Bullish or bearish divergences between the price and the stochastic can provide additional confirmation for potential trading signals.

7. Average True Range (ATR)

The Average True Range (ATR) measures market volatility by calculating the average of true ranges over a specified period. It helps traders understand how much an asset typically moves during a given time frame.

The ATR can be instrumental in establishing stop-loss levels and position sizes. A rising ATR suggests increasing volatility, indicating that traders should consider adjusting their risk management strategies accordingly.

Conclusion

In conclusion, using the right indicators in Forex trading can significantly enhance a trader’s ability to analyze the market and make informed decisions. Moving averages, RSI, MACD, Bollinger Bands, Fibonacci retracement levels, stochastic oscillator, and ATR are among the best indicators available for traders today.

Each indicator has its strengths and weaknesses, and the best approach is to combine multiple indicators for a comprehensive analysis. By leveraging these tools strategically, traders can improve their chances of success in the dynamic world of Forex trading.

Write a Comment