Effective Forex Trading Strategies for Success 1687288219

Effective Forex Trading Strategies for Success

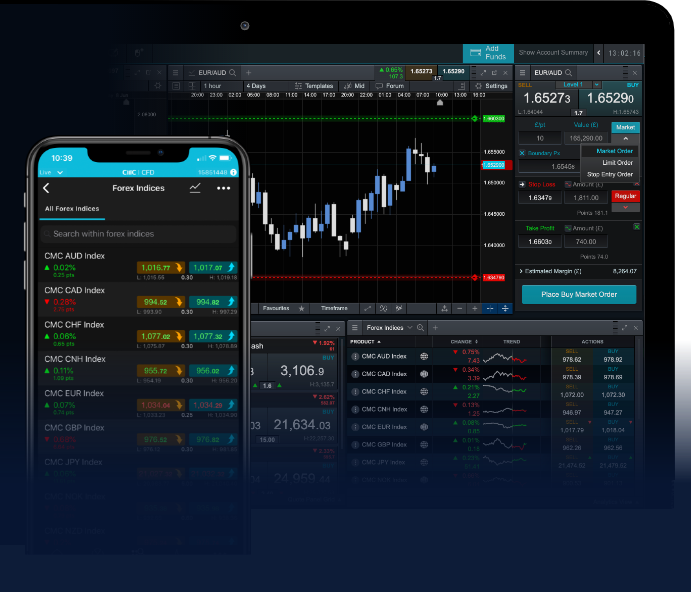

Forex trading, or foreign exchange trading, involves buying and selling currency pairs in the global market, aiming to make profits from fluctuations in exchange rates. It’s a dynamic field that attracts millions of traders worldwide. To navigate the complexities of Forex trading, having a solid strategy is crucial. Here, we will discuss some of the most effective Forex trading strategies and how you can implement them to improve your trading outcomes. Additionally, you can explore more resources at forex trading strategies Trading Cambodia.

1. Scalping Strategy

Scalping is a popular Forex trading strategy that focuses on making small profits from minor price changes. Traders who use this strategy, known as scalpers, typically hold positions for a few seconds to a few minutes. The goal is to accumulate profits through high trade volume. Scalping requires a trader to have a reliable trading platform, quick access to market data, and excellent risk management skills.

Advantages of Scalping

- Quick returns on investment

- Less exposure to market risk

- Opportunity to refine trading skills

Disadvantages of Scalping

- High transaction costs due to frequent trading

- Requires intense concentration and discipline

- May not be suitable for beginners

2. Day Trading Strategy

Day trading is another method where traders buy and sell currency pairs within the same trading day. The primary goal is to capitalize on short-term market movements. Most day traders often close their positions before the end of the day to avoid overnight risks. A successful day trading strategy requires a good understanding of market trends, technical analysis, and solid risk management.

Key Day Trading Techniques

- Technical Analysis: Using charts and indicators to identify potential price movements.

- Fundamental Analysis: Keeping an eye on news events that can affect currency values.

- Risk Management: Setting stop-loss orders to minimize losses on trades.

3. Swing Trading Strategy

Swing trading is a medium-term trading strategy where traders hold positions for several days to capture price swings. This strategy allows traders to take advantage of market volatility without the need to monitor the markets all day long. Swing traders often use a combination of technical and fundamental analysis to make their trading decisions.

Benefits of Swing Trading

- More relaxed than day trading

- Ability to profit from longer market movements

- Fewer trades mean potentially lower transaction costs

Drawbacks of Swing Trading

- Exposure to overnight market fluctuations

- Requires patience and emotional control

- Potential for larger capital drawdown during market corrections

4. Position Trading

Position trading is a long-term strategy where traders hold their positions for weeks, months, or even years. This strategy is less concerned with short-term market fluctuations and focuses more on the fundamentals and overall trends of the market. Position traders are often seen as investors rather than active traders.

Key Considerations for Position Trading

- In-depth market analysis to identify long-term trends

- Using broader economic indicators

- Implementing strict risk management to protect capital

5. Trend Following Strategy

The trend-following strategy is based on the premise that prices tend to move in persistent directions over time. Traders using this strategy will identify upward or downward trends and enter trades aligned with that trend. This strategy can be applied over various timeframes and fits well with both day and swing trading.

Tools for Trend Following

- Moving Averages: Helps to identify the underlying trend.

- Trendlines: Visual aids to determine key support and resistance levels.

- Momentum Indicators: Tools like the MACD and RSI to gauge the strength of trends.

6. Range Trading Strategy

Range trading is a strategy that involves identifying a price range in which a currency pair is trading. Traders will buy at the lower boundary and sell at the upper boundary of the range. This strategy is useful in sideways markets and requires a clear understanding of support and resistance levels.

Risk Management in Range Trading

- Setting stop-loss orders above resistance levels and below support levels.

- Avoiding trading during market news events that could break the range.

- Keeping a close eye on market sentiment for potential reversals.

Conclusion

Choosing the right Forex trading strategy can significantly influence your success in the market. Whether you opt for scalping, day trading, swing trading, position trading, trend following, or range trading, it’s essential to develop a solid plan, practice diligent risk management, and continuously educate yourself about market dynamics. As with any investment, trading Forex involves risk, and it’s important to remain disciplined and patient as you refine your strategies. With the right approach, you can make informed decisions and work towards achieving your trading goals.