Essential Forex Trading Tips for Beginners Your Path to Success 1801144172

Essential Forex Trading Tips for Beginners: Your Path to Success

If you are venturing into the world of forex trading, you may feel overwhelmed by the myriad of information available. To help get you started on the right path, we’ve compiled a list of essential forex trading tips for beginners that can guide you toward successful trading. Remember, success in forex trading requires diligence, patience, and a well-thought-out plan. For better understanding and resources, you might want to check out forex trading tips for beginners Latam Web Trading.

1. Understand the Basics

Before you start trading, it’s crucial to understand the basics of forex trading. Forex, or foreign exchange, involves buying one currency while simultaneously selling another. Currency pairs, such as EUR/USD or GBP/JPY, are how trades are conducted. Familiarize yourself with concepts like pips, lots, leverage, and margin.

2. Choose the Right Broker

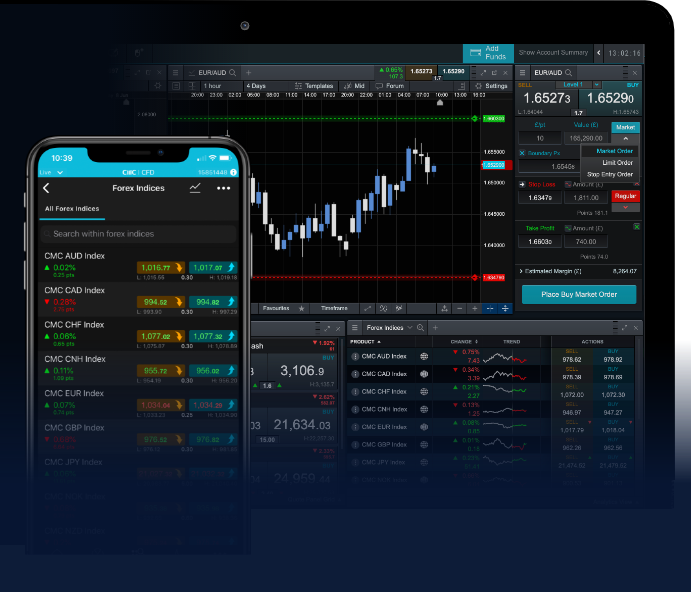

The choice of broker can significantly impact your trading experience. Look for a reputable broker that meets your needs. Ensure they are regulated by a governing body, offer a user-friendly trading platform, provide competitive spreads, and have a good range of trading tools and educational resources.

3. Develop a Trading Plan

One of the most vital forex trading tips is to have a well-defined trading plan. Outline your trading goals, risk tolerance, and strategies. Your plan should include how much you intend to invest, the currencies you want to trade, when you’ll enter and exit trades, and how you’ll manage your risk through stop-loss and take-profit orders.

4. Start with a Demo Account

Many brokers offer demo accounts that allow you to practice trading without risking real money. This is an excellent way to familiarize yourself with the trading platform, experiment with different strategies, and develop your skills before entering the live market.

5. Manage Your Risk

Risk management is essential in forex trading. The forex market can be volatile, and losses are inevitable. Use risk management techniques, such as setting stop-loss orders and limiting your position sizes. Never risk more than a small percentage of your trading capital on a single trade; many traders recommend no more than 1% to 3% per trade.

6. Keep Emotions in Check

Emotions can be detrimental to trading success. Fear and greed can cloud your judgment, leading to impulsive decisions. Stick to your trading plan and avoid overreacting to market fluctuations. Maintain a disciplined mindset and approach every trade logically.

7. Stay Informed

Stay updated with market news, economic indicators, and geopolitical developments that can influence currency prices. Economic calendars can help you track important events, such as interest rate decisions or employment reports. This knowledge helps you make informed trading decisions.

8. Embrace Technical and Fundamental Analysis

Successful forex trading involves both technical and fundamental analysis. Technical analysis focuses on price patterns and indicators to predict future movements, while fundamental analysis examines economic factors that drive currency values. A combination of both approaches can enhance your trading strategies.

9. Keep a Trading Journal

Maintaining a trading journal can be beneficial for your growth as a trader. Document your trades, strategies, and feelings about each trade. Review your performance regularly to identify patterns, mistakes, and areas for improvement. This self-reflection can lead to more informed trading decisions in the future.

10. Be Patient and Persistent

Forex trading is not a get-rich-quick scheme. It requires time, effort, and ongoing learning. Be prepared for setbacks and losses; they are part of the learning process. Stay committed to your trading plan and be patient as you develop your skills and understanding of the market.

11. Network with Other Traders

Consider joining trading communities, forums, or social media groups where you can connect with other traders. Engaging with others can provide support, insights, and different perspectives on trading strategies. Listening to the experiences of more seasoned traders can also enhance your learning.

12. Avoid Over-Leveraging

Leverage can magnify both profits and losses. While it allows you to control larger positions with a smaller amount of capital, it also increases your risk. Be cautious with the amount of leverage you use; it’s better to trade with a lower leverage ratio until you gain more experience and confidence.

Conclusion

Forex trading can be an exciting and profitable venture for beginners who approach it with the right mindset and knowledge. By understanding the basics, choosing a reputable broker, developing a solid trading plan, and applying effective risk management techniques, you can lay a strong foundation for your trading career. Embrace the journey with patience and a willingness to learn, and you will increase your chances of success in the dynamic world of forex trading.