Deposit Insurance policies casino WinTingo mobile Faqs

Posts

You could subtract projected income tax repayments you have made within the season to your state or local government. Although not, you’ll want a reasonable reason for making the estimated taxation repayments. People estimated county or local tax payments you to aren’t built in good-faith during percentage aren’t allowable. Your deduction can be to possess withheld taxation, projected taxation repayments, or any other tax repayments the following. The product quality deduction for an excellent decedent’s last tax come back is the same as it could was had the decedent continued to help you real time.

Casino WinTingo mobile | Tramway service

- Unemployment settlement fundamentally has any number acquired lower than an unemployment compensation laws of one’s Us or of your state.

- When you’re mind-working and rehearse your car on your own company, you might subtract the company element of county and you can local private possessions taxes to the motor vehicles to your Agenda C (Setting 1040) or Agenda F (Mode 1040).

- Find out how to interest the new disallowance several months in the Instructions to possess Form 8862, for more information on which to complete for individuals who disagree having all of our devotion that you could’t allege the credit for 2 otherwise ten years.

Any net income your import to your recharacterized sum are treated since the casino WinTingo mobile gained regarding the 2nd IRA. A qualified bundle is just one that fits the requirements of the brand new Interior Money Code. You may make one rollover from an IRA to another (or even the same) IRA in every step 1-year several months, long lasting amount of IRAs you own.

Put Insurance policies Frequently asked questions

Take note you to definitely although this option head deposit strategy worked for the majority of, eventually, the sole a hundred% foolproof strategy is to accomplish an authentic head deposit of your employer salary or bodies pros. For many who’re a new comer to financial bonuses, bear in mind banks get alter what truly matters otherwise doesn’t amount while the a direct put at any time. Individually, sometimes I do force transmits from a few some other banking institutions to improve the potential for victory. For everybody other intents and you can objectives, truth be told there really isn’t a difference among them, but also for creating bank bonuses, banking companies is only going to believe force transfers since the something which qualifies because the a primary put. All the courtroom sports betting websites in the us render the players with fantastic signal-upwards campaigns.

$1 put gambling enterprises having free spin bonuses

If you don’t render your employer a finished Setting W-4, your employer must keep back in the high speed, just like you have been unmarried. 505 or perhaps the worksheets put into Function W-cuatro, to determine if you ought to have their withholding improved otherwise decreased.. If the events within the 2025 vary the level of withholding you is to claim to possess 2026, you must offer your boss a new Mode W-cuatro because of the December step 1, 2025. If your enjoy happens in December 2025, fill in another Mode W-4 within this ten days. When you begin another work, you should fill in Function W-cuatro and provide it to the employer.

Therefore, your companion does not satisfy so it test and you can’t claim him or her as the a reliant. In case your dependent died in the season and you also otherwise meet the requirements to point out that person while the a reliant, you could nonetheless say that person as the a centered. You’re able to lose children as your being qualified cousin even if the son has been kidnapped.

You’ll see that the amounts within this diversity have 9 digits, and this the word “9 numbers”. The menu of people who secure $a hundred million or maybe more per year is basically populated by highly successful entrepreneurs and you can buyers. With regards to conventional careers, it’s nearly impractical to achieve the 9 profile annually endurance.

Preferred payment strategies for $step 1 dumps

Fundamentally, a married pair can be’t document a mutual go back in the event the each one is actually a good nonresident alien when inside the taxation season. However, if a person companion are a good nonresident alien or twin-reputation alien who was partnered to help you a U.S. resident otherwise resident alien at the end of the entire year, the fresh partners can pick in order to file a shared go back. If you do file a shared come back, you and your partner is actually each other addressed since the U.S. citizens for the entire taxation seasons. Install a finalized statement to the return detailing that your particular partner try providing inside the a combat area. To learn more about unique income tax laws to possess persons that serving within the a fight zone, otherwise that are within the forgotten position right down to helping inside the a battle region, find Pub. You’re stored jointly and you can in person accountable for any taxation, interest, and you may charges due to your a mutual go back recorded prior to your breakup.

Another sort of payments is actually managed since the your retirement otherwise annuity earnings and so are nonexempt under the laws said inside Club. Jury obligation shell out you get need to be used in your revenue on the Agenda step 1 (Setting 1040), range 8h. You’re in a position to ban from money the eye away from qualified You.S. deals bonds you redeem for individuals who pay accredited degree expenses in the same season. More resources for which exclusion, come across Education Savings Bond Program under U.S.

- About your first disadvantage, it’s best when on the web sportsbooks render personal bonus choice credit ($twenty five for each, such) as opposed to a lump sum payment.

- Never enter into any other information about one range, and also finish the spaces less than you to line.

- Now, accurate documentation 15 anyone cut it to your Forbes’ 2025 Community’s Billionaires list, up of 14 last year and you will half dozen within the 2023.

- Yet not, because the compensation wasn’t treated while the earnings otherwise while the other taxable earnings, you could potentially’t deduct the costs.

Energetic December 31, 2010 all the noninterest-affect purchase deposit account are completely covered for the entire number in the deposit account. Which endless insurance is actually short term and can remain in feeling anyway FDIC-insured depository organizations due to December 31, 2012. Hard rock Choice has numerous banking tips for professionals to choose from, in addition to financial transfers, debit notes, PayPal, and you will Venmo.

You possibly can make distributions out of your Red-dog membership with credit notes, cryptocurrency, or bank cord. 9 numbers refers to the range between $one hundred million and you may $999.9 million, that are levels of money thus higher that every anyone usually do not relate with her or him most meaningfully. To help you train, we want to say that the typical American brings in ranging from $step 1.13 and $step 3.05 million within whole existence.

You’re an excellent 22-year-dated student and will getting stated while the a depending on the the parents’ 2024 income tax come back. You have got $1,500 inside interest money and you may wages out of $step three,800 and no itemized write-offs. You place contours 1 and 2 and you can enter $4,250 ($step 3,800 + $450) on the web step 3.

ParlayPlay Bonus Offer

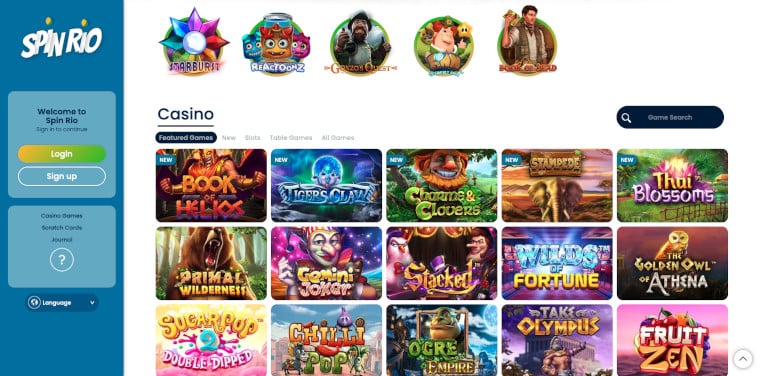

Sign up for your chosen $step 1 deposit gambling enterprise Canada and you will stimulate your bank account by giving the brand new necessary information. Novices is welcomed which have a-c$1000 prize that can be used to earn a bunch of cash if they score happy. But not, the fresh wagering dependence on 70x is found on the new higher side. Despite the fact that, Twist Local casino is actually a leading program giving safe money and you can big rewards.

A state charges an annual motor vehicle membership tax of just one% of value in addition to fifty cents for every hundredweight. Your paid back $32 in line with the well worth ($1,500) and weight (3,400 weight.) of your automobile. You could potentially deduct $15 (step 1% × $step 1,500) as the an individual possessions income tax since it is in line with the well worth. The remaining $17 ($0.50 × 34), in line with the pounds, isn’t allowable. In case your taxing power (otherwise home loan company) doesn’t give you a duplicate of one’s home tax bill, require it..

Write a Comment