Mortgage and credit power calculator

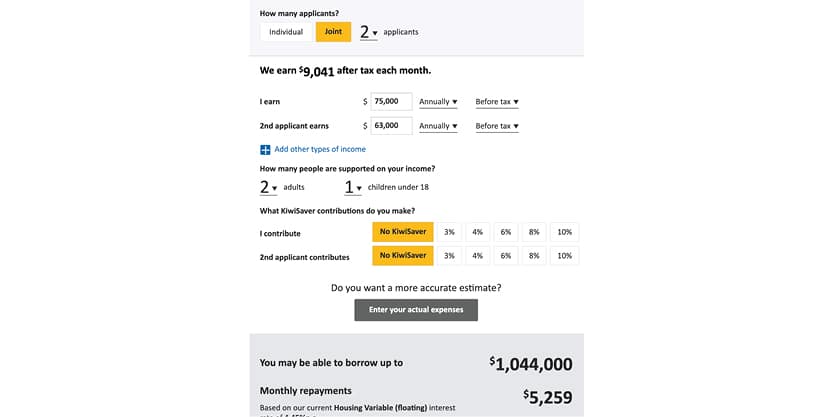

Your LVR is the amount you’ll need acquire while the a portion of the home really worth. Very loan providers believe an LVR of greater than 80% becoming a risk, since your month-to-month repayments would be a lot higher. Yes, HECS personal debt can reduce the credit energy since the repayments reduce your throw away earnings and increase your debt-to-earnings proportion, which lenders used to regulate how far you might borrow. Sure, applying which have a partner increases your borrowing from the bank electricity because your joint income is large along with your total financial position is actually more powerful. Although not, lenders will evaluate each of your financial situation and you can credit histories, that will impact the lead. If sometimes partner have significant debts or a dismal credit rating, this may reduce the count you could potentially use.

Borrowing Power Calculator | Expenses & bills (excl. rent)

This is going to make your repayments more costly and it may restrict how much you could potentially use. For example, larger banking institutions are more conservative, although some online lenders specialize within the finance for people with lowest credit ratings or prior bankruptcies. That it scale will eliminate economic climate dangers since the property borrowing from the bank gains and you can costs rise. Interest rates are influenced by the new economic places and certainly will change each day – or several times inside exact same time. The changes are based on many different financial symptoms from the financial locations. Were number you pay monthly on the signature loans and people hire orders.

LVR is the quantity of the loan compared to the Bank’s valuation of your property accessible to safer the loan conveyed since the a portion. Financial Borrowing Power Calculator cost for brand new money are set in line with the very first LVR and will not transform within the lifetime of the mortgage as the LVR alter. Loan in order to Value ratio (LVR) is the complete number you have borrowed for your financing while the a share of your house value. Minimal credit number is $ten,000 becoming qualified to receive a home loan. Wealth Plan prices wanted at least 1st plan financing balance of $150,100.

$0 global transfer costs

I encourage trying to separate economic information prior to making people financial behavior. Prior to acquiring people financial device, see and study the relevant Tool Disclosure Declaration (PDS), Audience Commitment (TMD), and just about every other render data. To possess lenders, the bottom conditions are a good $five hundred,100 loan amount more than three decades. This type of prices are merely examples and could maybe not were all charges and fees. Your credit report isn’t generally utilized in credit strength computations, your financial history is a thing a loan provider will look in the when determining your home loan application.

Examine mortgage costs

Rating a customized picture of our interest levels and you can financing provides. Publication within the a speak to one of the friendly benefits, or begin implementing on the internet and we are going to enter touch. Submit in the around 20 minutes (otherwise struck ‘save’ and you will go back) and we’ll get into reach. Given that the new NerdWallet “Simply how much should i obtain calculator” gave your an idea of their to shop for strength, you can even gut-read the number with the second steps. Holden Lewis is actually an old NerdWallet spokesman and you can reporter layer mortgage loans and a property.

They signifies that your repaired houses will set you back (home loan repayments, insurance policies, rates) will be if at all possible getting only about twenty eight% of your money before taxation. For individuals who include your own almost every other most recent personal debt costs (fund, handmade cards, store borrowing from the bank) it needs to be only about thirty six% of your own income ahead of tax. The outcomes of the calculator is actually an estimate just for Tiimely Individual issues. That it calculator cannot think HECS debts, which could lower your borrowing from the bank capacity. Should you choose a home loan having our committee out of loan providers playing with a good Tiimely Family broker, their credit skill can differ centered on the loan options. When figuring your house loan borrowing strength, the an excellent personal debt and you may credit score are thought.

Of numerous things can be determine their expenses, as well as members of the family you economically support, established debt, or other financial obligations, just like your medical insurance policy. Your own borrowing skill will be more realistic for individuals who get into direct information to the calculator, therefore you should begin by examining their expenses. All Apps try subject to credit check, eligibility conditions and lending limits. Advice given try truthful information merely, and that is perhaps not intended to suggest people testimonial from the people economic product(s) or create tax information. For many who want financial or taxation guidance you should consult a authorized financial or taxation agent.

In less than five full minutes, you can purchase the application already been to possess pre-approvaldisclaimer, a new mortgage, refinancing, otherwise topping your present financial. You may also have the ability to improve simply how much you could acquire from the inquiring a relative to ensure all the, otherwise region, of one’s financing. During the Westpac, this can be named a family Protection Ensure also it may help you get to the market eventually.

The credit electricity are a rough formula of your own ability to borrow money. Generally, it’s a sign of simply how much you really can afford to help you use if you are nonetheless to be able to satisfy the almost every other bills. Using our borrowing from the bank electricity calculator provides you with a sense of what you could borrow.

ING Wallet Rewards is actually a benefits system for Lime Informal Debit Cards owners. For every debit cards you possess have a tendency to instantly end up being signed up for the ING Wallet Benefits. ING Wallet Perks also provides is subject to certain qualification requirements lay by seller offering the render, and these details might possibly be displayed on the ‘Offers’ element of the new ING software. Cashback can be credited within this one week away from a great qualifying get becoming fully canned.

Terms of service

Large five financial Westpac have added as much as thirty five base things to help you the fixed financial rates after t… A couple of Australia’s most recognisable banks elevated fixed financial cost to your Tuesday, followi… Not knowing about what form of home loan you might be qualified to possess? You could potentially evaluate a number of the low-rate home loan points below. Our very own totally free device gives a quotation away from how large a great financial a lender could be prepared to give for your requirements according to your earnings and you may expense.

Finder.com is a different research system and advice service whose goal is to offer the various tools you ought to make smarter decisions. As we is independent, the newest offers that appear on this site come from enterprises of and this Finder get compensation. We may found payment from your people for keeping the goods and services.

Knowing the home loan processes

You should getting practical when examining your credit energy. Be honest regarding the earnings and expenditures, and make sure in order to reason behind your entire will cost you whenever choosing how much you could potentially borrow. That way, it is possible and make an educated choice about your borrowing strength. Borrowing from the bank energy, labeled as borrowing from the bank skill, implies the new projected matter you are permitted borrow to own your property mortgage. The borrowing from the bank power will be based upon the money you owe and you can credit rating.

Write a Comment